Defined contribution plan calculator

A Spectrum of Investment Solutions to Address the Needs of Defined Benefit Plan Sponsors. Ad Theres no minimum balance to open a CD account.

Dcpp Vs Rrsp Which Pension Plan Is Better For Your Needs

One way to do this is to use a reduced plan contribution rate.

. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Our calculator is intended to be a year. Decide when your CD account interest is paid outend of term monthly or annually.

Ad Try our free defined benefit calculator to see how much you can save. You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan. The cash balance plan calculator is meant solely for illustrative purposes.

Do Your Investments Align with Your Goals. A One-Stop Option That Fits Your Retirement Timeline. 1 year of service 0 vested of.

Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Defined Benefit Plan Individual 401k SEP IRA or. Ad Discover The Benefits Of A Traditional IRA. Ad Personalized Tools and Capabilities For You And Your Employees.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Beginning July 1 2013 this option will be made available to all. This chart highlights some of the basic RMD rules as applied to IRAs and defined contribution plans eg 401k profit-sharing and 403b plans.

Compute Your Contributions Today. Learn About 2021 Contribution Limits Today. Deposit what works best for you.

401k - One of the most common defined contribution plans the 401k is considered nontaxable income for employees and employers. Customize a Retirement Plan For Your Needs. The defined-contribution plan is a type of pension fund to which an employee andor an employer contribute based on terms agreed to by both parties.

Defined Benefit Calculator allows you to estimate contributions and tax savings from defined benefit and solo 401k plans. Employees can opt to contribute. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Find a Dedicated Financial Advisor Now. Use this calculator to help you manage withdrawals from your. It is intended to be an estimate and final funding is determined by our actuary.

A Cash Balance plan is a type of Defined Benefit. See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. The schedule is as follows.

A blended defined benefit and defined contribution retirement plan for the majority of VRS members hired on or after January 1 2014. For more information or to do calculations involving each of them please visit the 401. Ad Its Time For A New Conversation About Your Retirement Priorities.

Ad Get Defined Benefit Investing Insights From Capital Groups LDI Solutions Team. Learn More Account Access. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

On March 16 2012 Governor Andrew Cuomo signed into law a new Voluntary Defined Contribution Plan. Ad Its Time For A New Conversation About Your Retirement Priorities. If you have more than one defined.

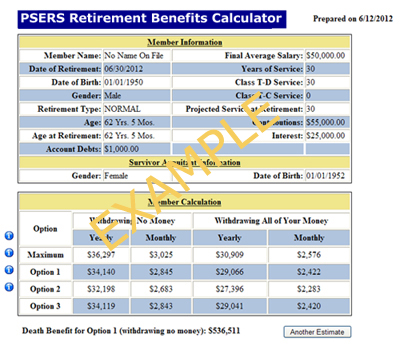

In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA plans. Defined Contribution Calculator Combined Plan Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions of the. With the Member Benefit Estimator you enter information to estimate your retirement benefit for the defined benefit component of your plan including average final.

According to the plan he makes a contribution of 2000 in a year. Defined Benefit Calculator The 2-minute Proposal Easily estimate contribution and tax savings Our calculator takes 2 minutes to create an estimation of Maximum annual DB. The organization employs the Defined Contribution Pension Plan for its employees and Michael opts for it.

The Cash Balance plan has become more popular with the self-employed and small business owners who are looking to pay less taxes. Members vest in the employer contributions on a schedule that equals 100 percent vesting with five years of service.

Employee Painters Trust Fund

Understanding Maximum Transfer Value Rules Advisor S Edge

Infopensions Issue 25 November 2021

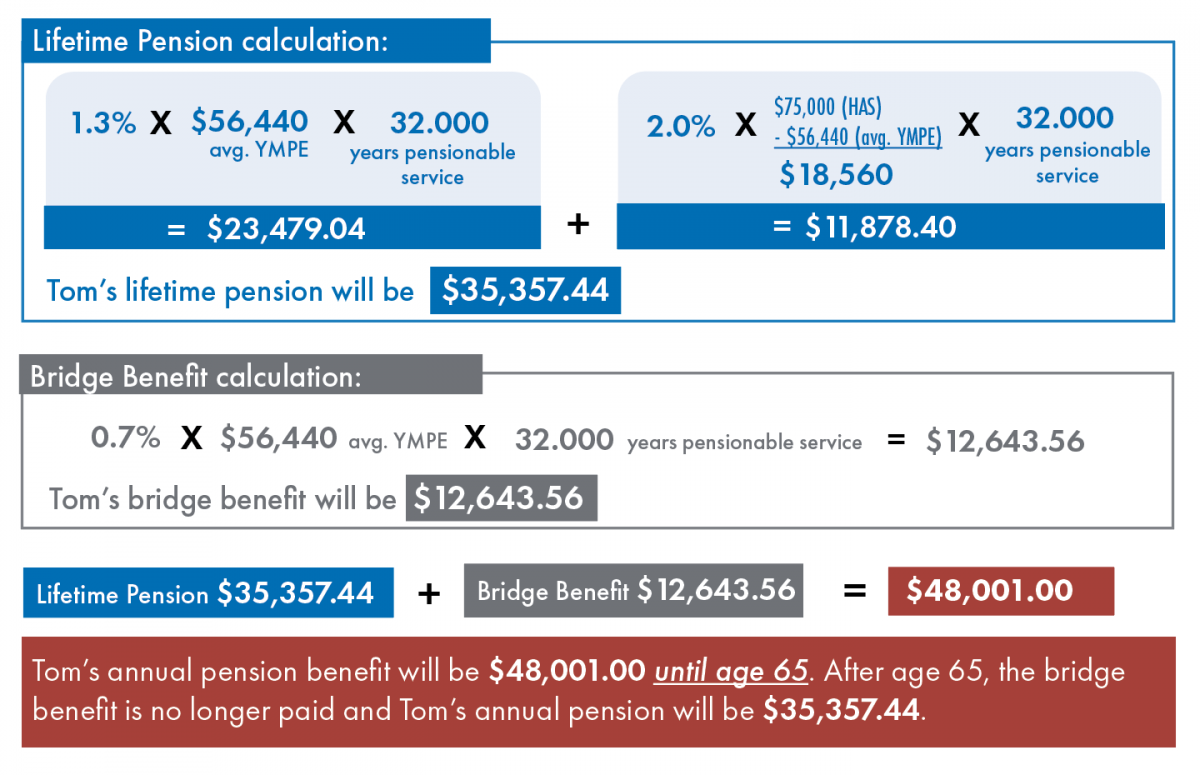

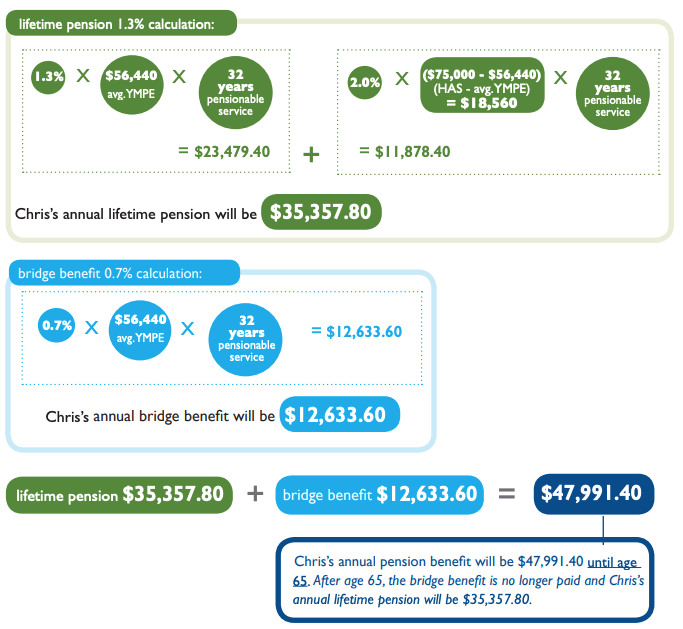

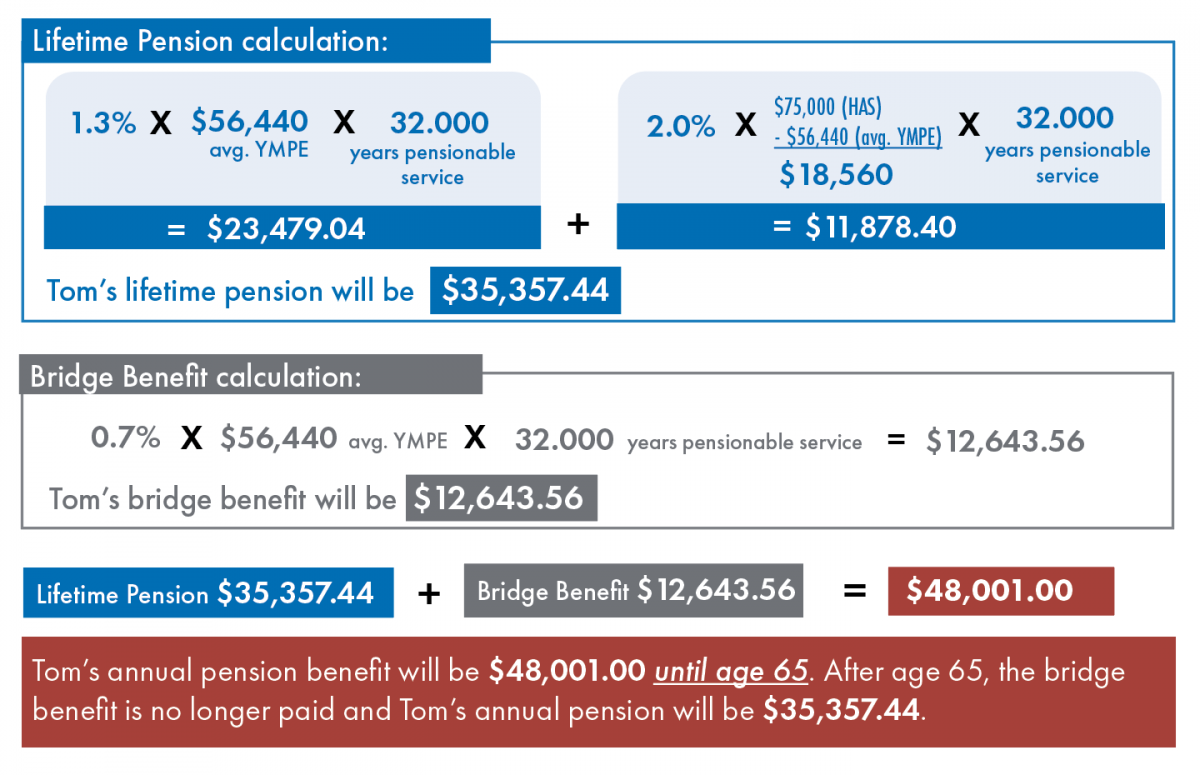

How Your Pension Is Calculated Nova Scotia Public Service Superannuation Plan

Sales Tax Calculator

Defined Benefit Pension Calculator Cetv Calculator Pensions Salary Calculator

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Retirement Calculator

Calculation For Commuted Pension Values Confusing To Some Plan Members Actuary Benefits Canada Com

Pensions For Talent

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Why Defined Benefit Pension Transfer Reports Are Always Negative Iexpats

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

How Your Pension Is Calculated Nova Scotia Teacher S Pension Plan

Christian Brothers Services Understanding Protecting Guiding

Converting Pension Plans From Defined Benefit To Defined Contribution The Myths And The Messaging Part 2 American Legislative Exchange Council

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition